I am pleased to announce the rfm package, a set of tools for recency, frequency and monetary value analysis, designed keeping in mind beginner/intermediate R users. It can handle:

- transaction level data

- customer level data

Installation

# Install release version from CRAN

install.packages("rfm")

# Install development version from GitHub

# install.packages("devtools")

devtools::install_github("rsquaredacademy/rfm")Shiny App

rfm includes a shiny app which can be launched using

rfm_launch_app()or try the live version here.

Read on to learn more about the features of rfm, or see the rfm website for detailed documentation on using the package.

Introduction

## Warning: package 'knitr' was built under R version 3.5.2## Warning: package 'DT' was built under R version 3.5.2RFM (recency, frequency, monetary) analysis is a behavior based technique used to segment customers by examining their transaction history such as

- how recently a customer has purchased (recency)

- how often they purchase (frequency)

- how much the customer spends (monetary)

It is based on the marketing axiom that 80% of your business comes from 20% of your customers. RFM helps to identify customers who are more likely to respond to promotions by segmenting them into various categories.

Data

To calculate the RFM score for each customer we need transaction data which should include the following:

- a unique customer id

- date of transaction/order

- transaction/order amount

rfm includes a sample data set rfm_data_orders which includes the above details:

rfm_data_orders## # A tibble: 4,906 x 3

## customer_id order_date revenue

## <chr> <date> <dbl>

## 1 Mr. Brion Stark Sr. 2004-12-20 32

## 2 Ethyl Botsford 2005-05-02 36

## 3 Hosteen Jacobi 2004-03-06 116

## 4 Mr. Edw Frami 2006-03-15 99

## 5 Josef Lemke 2006-08-14 76

## 6 Julisa Halvorson 2005-05-28 56

## 7 Judyth Lueilwitz 2005-03-09 108

## 8 Mr. Mekhi Goyette 2005-09-23 183

## 9 Hansford Moen PhD 2005-09-07 30

## 10 Fount Flatley 2006-04-12 13

## # ... with 4,896 more rowsRFM Score

So how is the RFM score computed for each customer? The below steps explain the process:

A recency score is assigned to each customer based on date of most recent purchase. The score is generated by binning the recency values into a number of categories (default is 5). For example, if you use four categories, the customers with the most recent purchase dates receive a recency ranking of 4, and those with purchase dates in the distant past receive a recency ranking of 1.

A frequency ranking is assigned in a similar way. Customers with high purchase frequency are assigned a higher score (4 or 5) and those with lowest frequency are assigned a score 1.

Monetary score is assigned on the basis of the total revenue generated by the customer in the period under consideration for the analysis. Customers with highest revenue/order amount are assigned a higher score while those with lowest revenue are assigned a score of 1.

A fourth score, RFM score is generated which is simply the three individual scores concatenated into a single value.

The customers with the highest RFM scores are most likely to respond to an offer. Now that we have understood how the RFM score is computed, it is time to put it into practice. Use rfm_table_order() to generate the score for each customer from the sample data set rfm_data_orders.

rfm_table_order() takes 8 inputs:

data: a data set with- unique customer id

- date of transaction

- and amount

customer_id: name of the customer id columnorder_date: name of the transaction date columnrevenue: name of the transaction amount columnanalysis_date: date of analysisrecency_bins: number of rankings for recency score (default is 5)frequency_bins: number of rankings for frequency score (default is 5)monetary_bins: number of rankings for monetary score (default is 5)

RFM Table

analysis_date <- lubridate::as_date("2006-12-31", tz = "UTC")

rfm_result <- rfm_table_order(rfm_data_orders, customer_id, order_date, revenue, analysis_date)

rfm_result| customer_id | date_most_recent | recency_days | transaction_count | amount | recency_score | frequency_score | monetary_score | rfm_score |

|---|---|---|---|---|---|---|---|---|

| Abbey O’Reilly DVM | 2006-06-09 | 205 | 6 | 472 | 3 | 4 | 3 | 343 |

| Add Senger | 2006-08-13 | 140 | 3 | 340 | 4 | 1 | 2 | 412 |

| Aden Lesch Sr. | 2006-06-20 | 194 | 4 | 405 | 3 | 2 | 3 | 323 |

| Admiral Senger | 2006-08-21 | 132 | 5 | 448 | 4 | 3 | 3 | 433 |

| Agness O’Keefe | 2006-10-02 | 90 | 9 | 843 | 5 | 5 | 5 | 555 |

| Aileen Barton | 2006-10-08 | 84 | 9 | 763 | 5 | 5 | 5 | 555 |

| Ailene Hermann | 2006-03-25 | 281 | 8 | 699 | 3 | 5 | 5 | 355 |

| Aiyanna Bruen PhD | 2006-04-29 | 246 | 4 | 157 | 3 | 2 | 1 | 321 |

| Ala Schmidt DDS | 2006-01-16 | 349 | 3 | 363 | 2 | 1 | 2 | 212 |

| Alannah Borer | 2005-04-21 | 619 | 4 | 196 | 1 | 2 | 1 | 121 |

rfm_table_order() will return the following columns as seen in the above table:

customer_id: unique customer iddate_most_recent: date of most recent visitrecency_days: days since the most recent visittransaction_count: number of transactions of the customeramount: total revenue generated by the customerrecency_score: recency score of the customerfrequency_score: frequency score of the customermonetary_score: monetary score of the customerrfm_score: RFM score of the customer

Segments

Let us classify our customers based on the individual recency, frequency and monetary scores.

| Segment | Description | R | F | M |

|---|---|---|---|---|

| Champions | Bought recently, buy often and spend the most | 4 - 5 | 4 - 5 | 4 - 5 |

| Loyal Customers | Spend good money. Responsive to promotions | 2 - 5 | 3 - 5 | 3 - 5 |

| Potential Loyalist | Recent customers, spent good amount, bought more than once | 3 - 5 | 1 - 3 | 1 - 3 |

| New Customers | Bought more recently, but not often | 4 - 5 | <= 1 | <= 1 |

| Promising | Recent shoppers, but haven’t spent much | 3 - 4 | <= 1 | <= 1 |

| Need Attention | Above average recency, frequency & monetary values | 2 - 3 | 2 - 3 | 2 - 3 |

| About To Sleep | Below average recency, frequency & monetary values | 2 - 3 | <= 2 | <= 2 |

| At Risk | Spent big money, purchased often but long time ago | <= 2 | 2 - 5 | 2 - 5 |

| Can’t Lose Them | Made big purchases and often, but long time ago | <= 1 | 4 - 5 | 4 - 5 |

| Hibernating | Low spenders, low frequency, purchased long time ago | 1 - 2 | 1 - 2 | 1 - 2 |

| Lost | Lowest recency, frequency & monetary scores | <= 2 | <= 2 | <= 2 |

Segmented Customer Data

We can use the segmented data to identify

- best customers

- loyal customers

- at risk customers

- and lost customers

Once we have classified a customer into a particular segment, we can take appropriate action to increase his/her lifetime value.

Segment Size

Now that we have defined and segmented our customers, let us examine the distribution of customers across the segments. Ideally, we should have very few or no customer in segments such as At Risk or Needs Attention.

segments %>%

count(segment) %>%

arrange(desc(n)) %>%

rename(Segment = segment, Count = n)## # A tibble: 10 x 2

## Segment Count

## <chr> <int>

## 1 Loyal Customers 288

## 2 Lost 185

## 3 At Risk 180

## 4 Potential Loyalist 147

## 5 About To Sleep 58

## 6 Others 48

## 7 Need Attention 34

## 8 Promising 21

## 9 Can't Lose Them 17

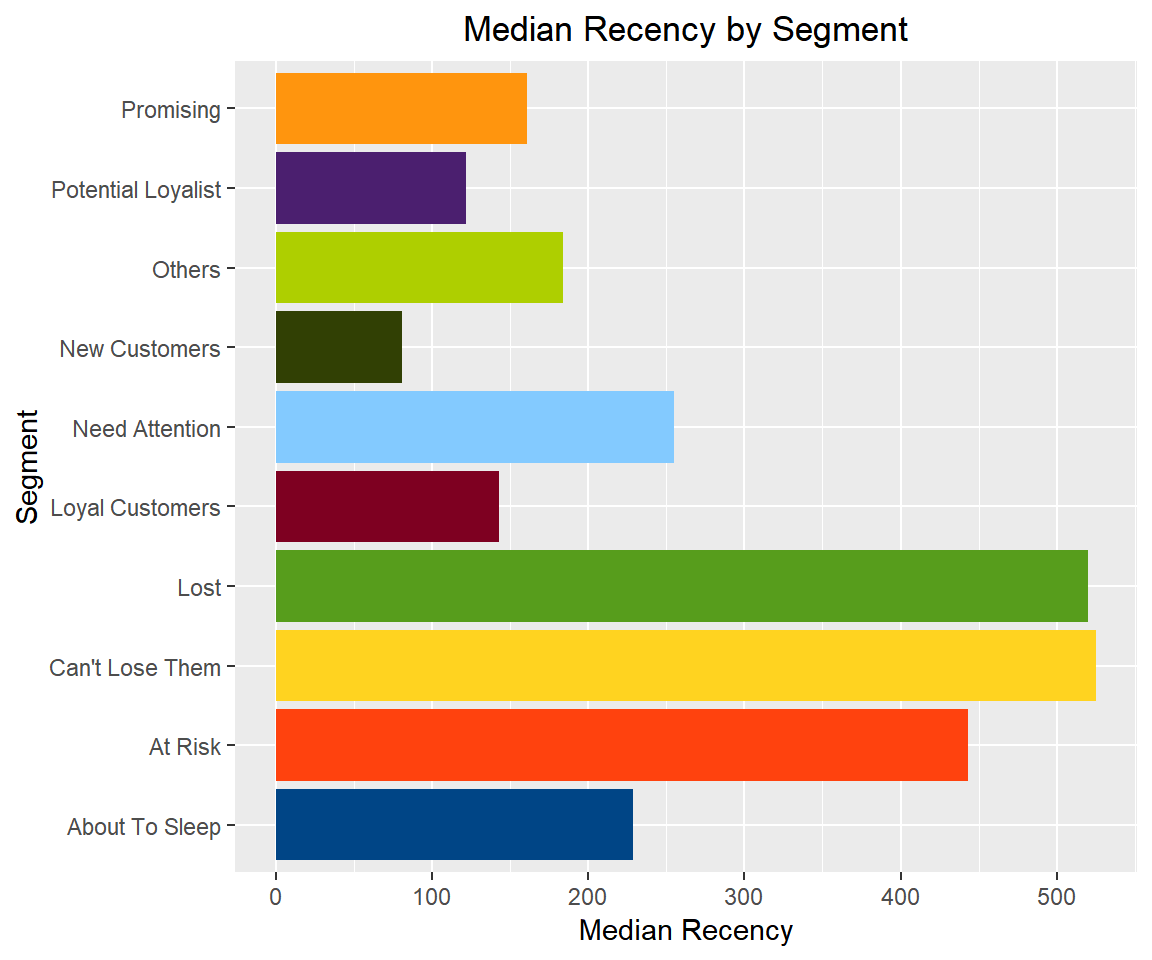

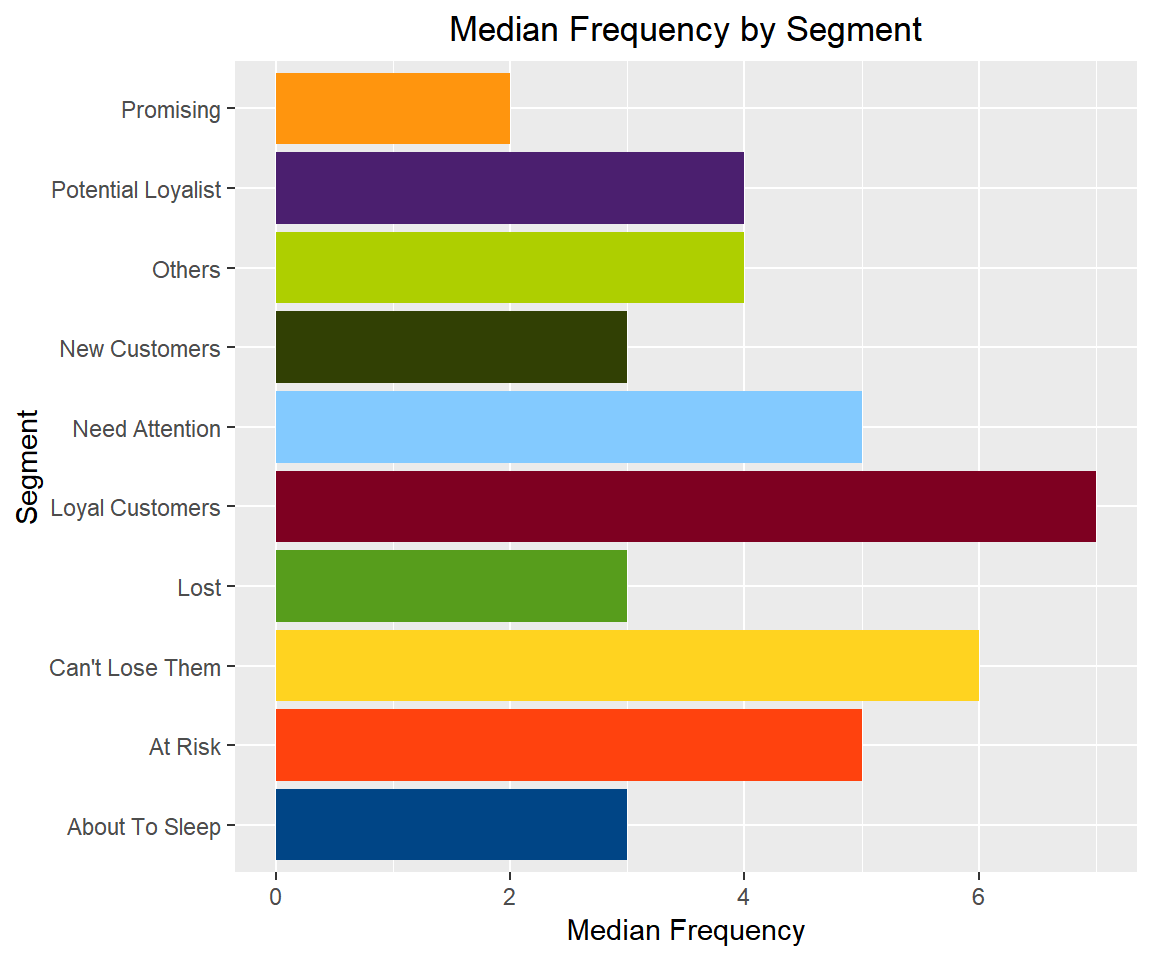

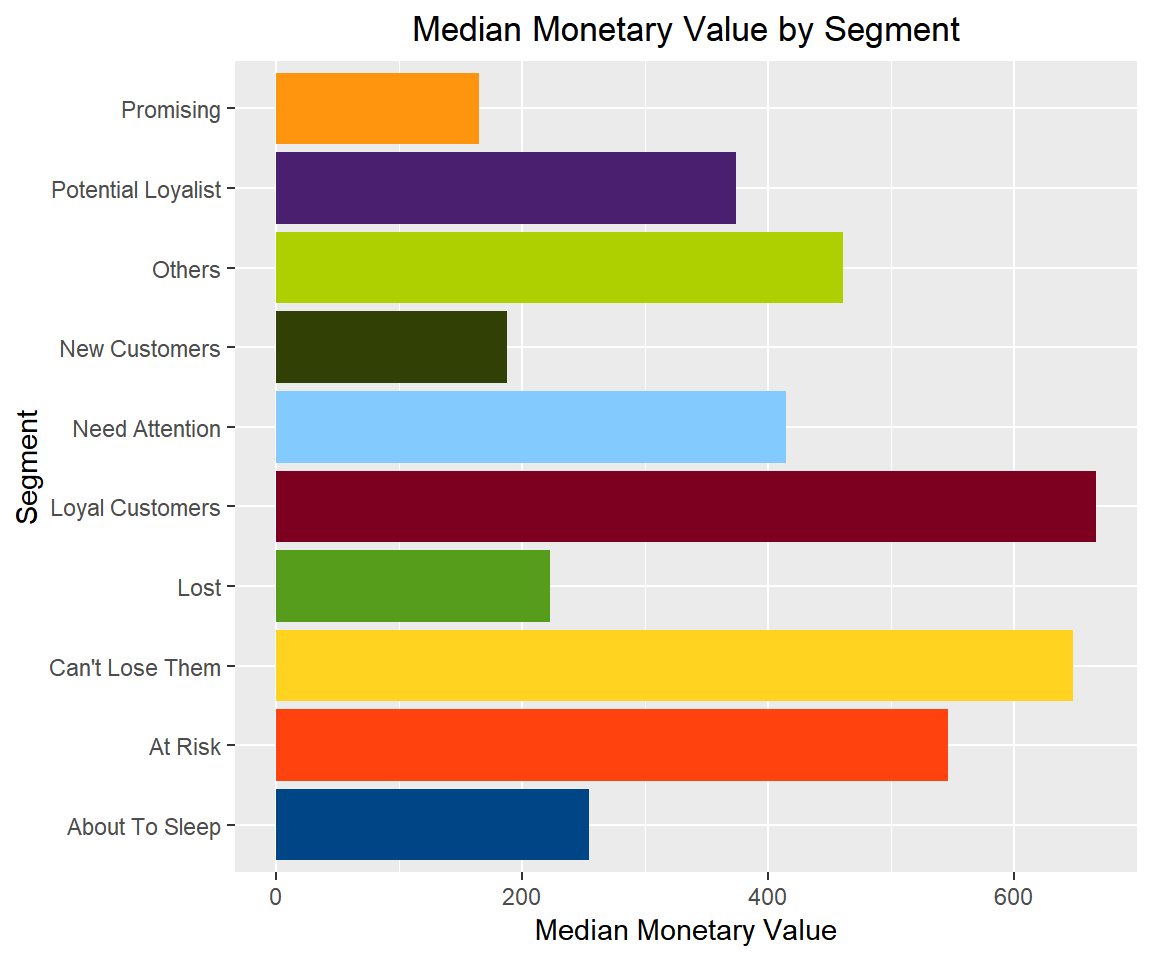

## 10 New Customers 17We can also examine the median recency, frequency and monetary value across segments to ensure that the logic used for customer classification is sound and practical.

Median Recency

rfm_plot_median_recency(segments)

Median Frequency

rfm_plot_median_frequency(segments)

Median Monetary Value

rfm_plot_median_monetary(segments)

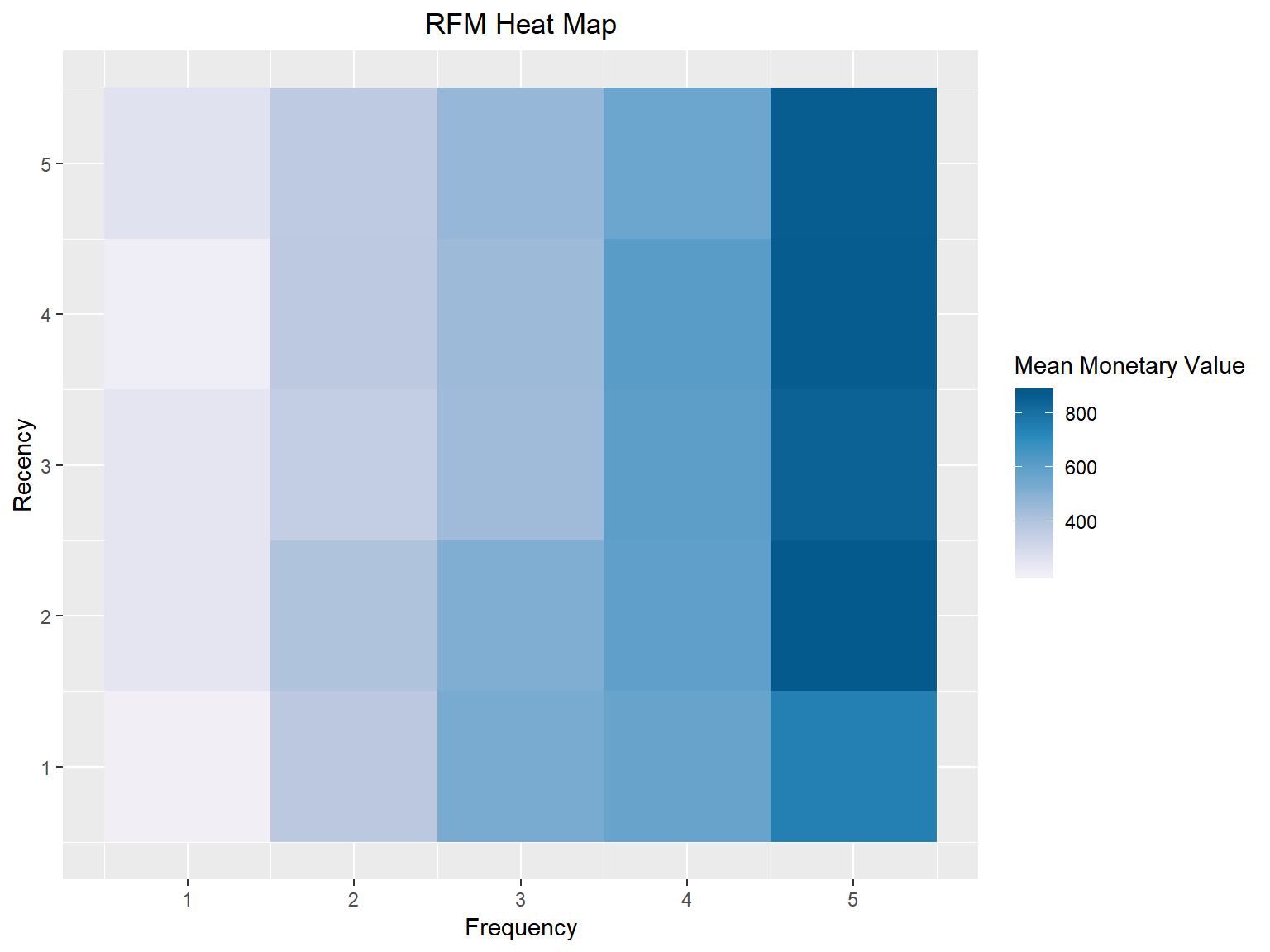

Heat Map

The heat map shows the average monetary value for different categories of recency and frequency scores. Higher scores of frequency and recency are characterized by higher average monetary value as indicated by the darker areas in the heatmap.

rfm_heatmap(rfm_result)

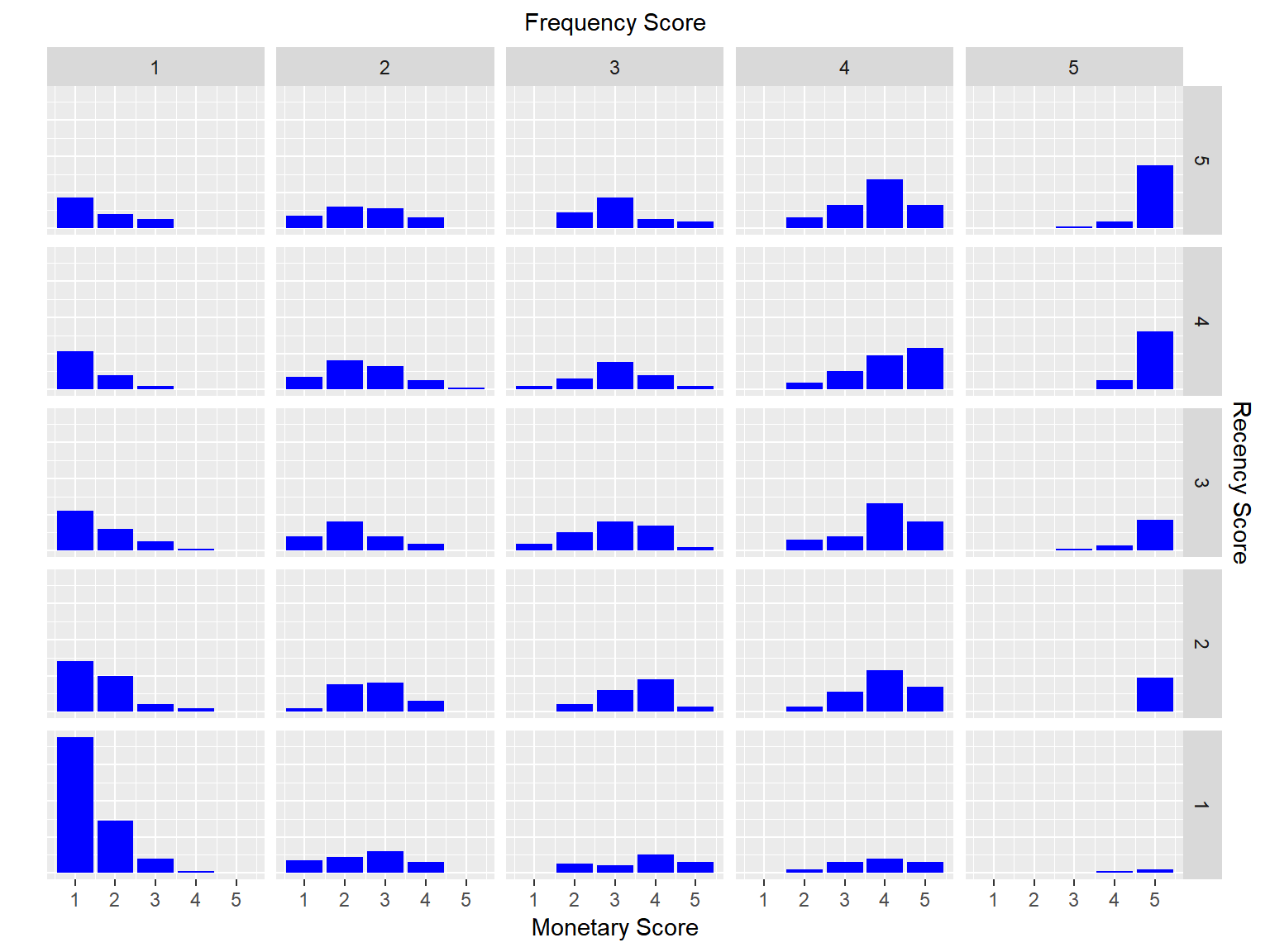

Bar Chart

Use rfm_bar_chart() to generate the distribution of monetary scores for the different combinations of frequency and recency scores.

rfm_bar_chart(rfm_result)

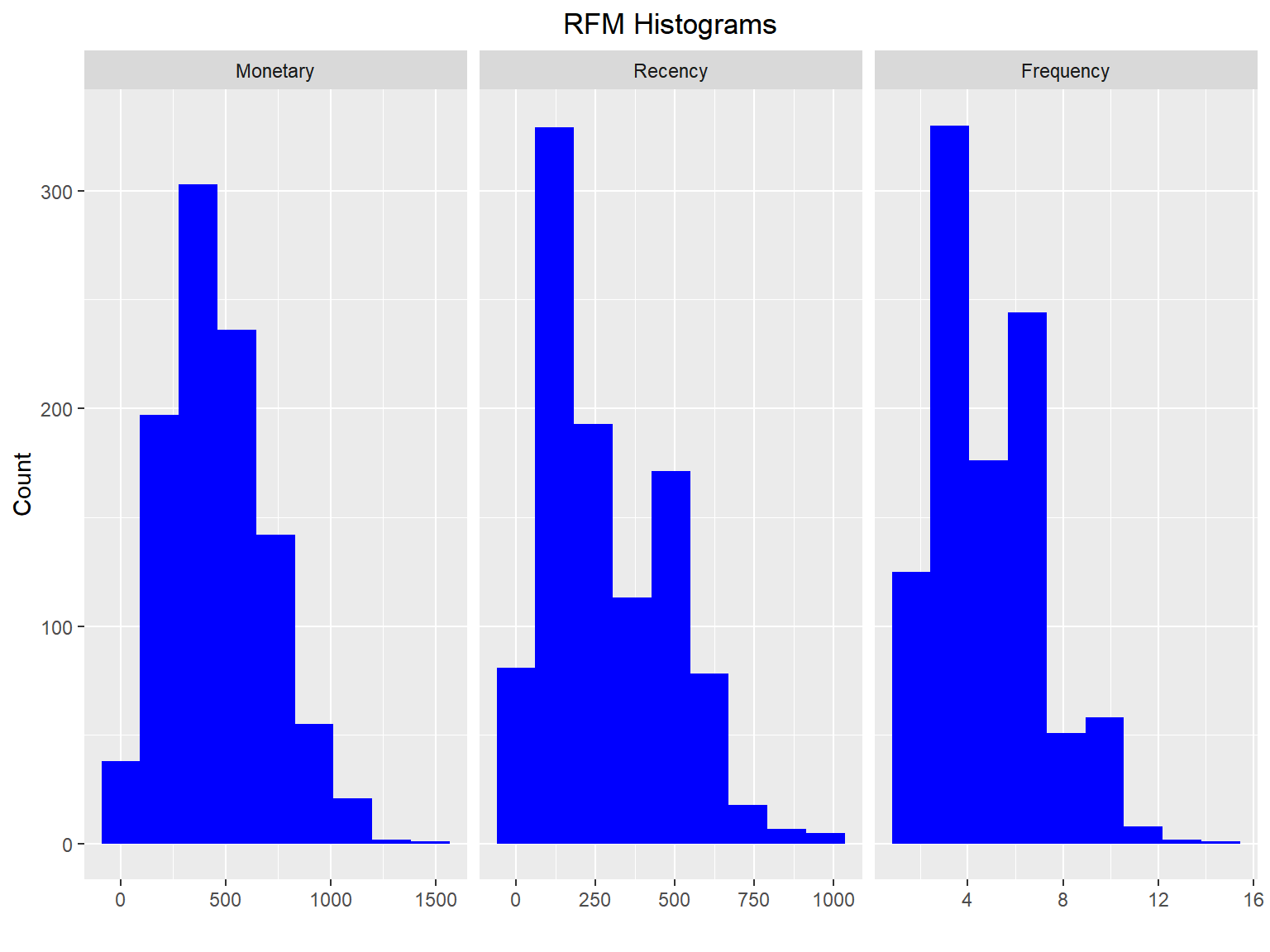

Histogram

Use rfm_histograms() to examine the relative distribution of

- monetary value (total revenue generated by each customer)

- recency days (days since the most recent visit for each customer)

- frequency (transaction count for each customer)

rfm_histograms(rfm_result)

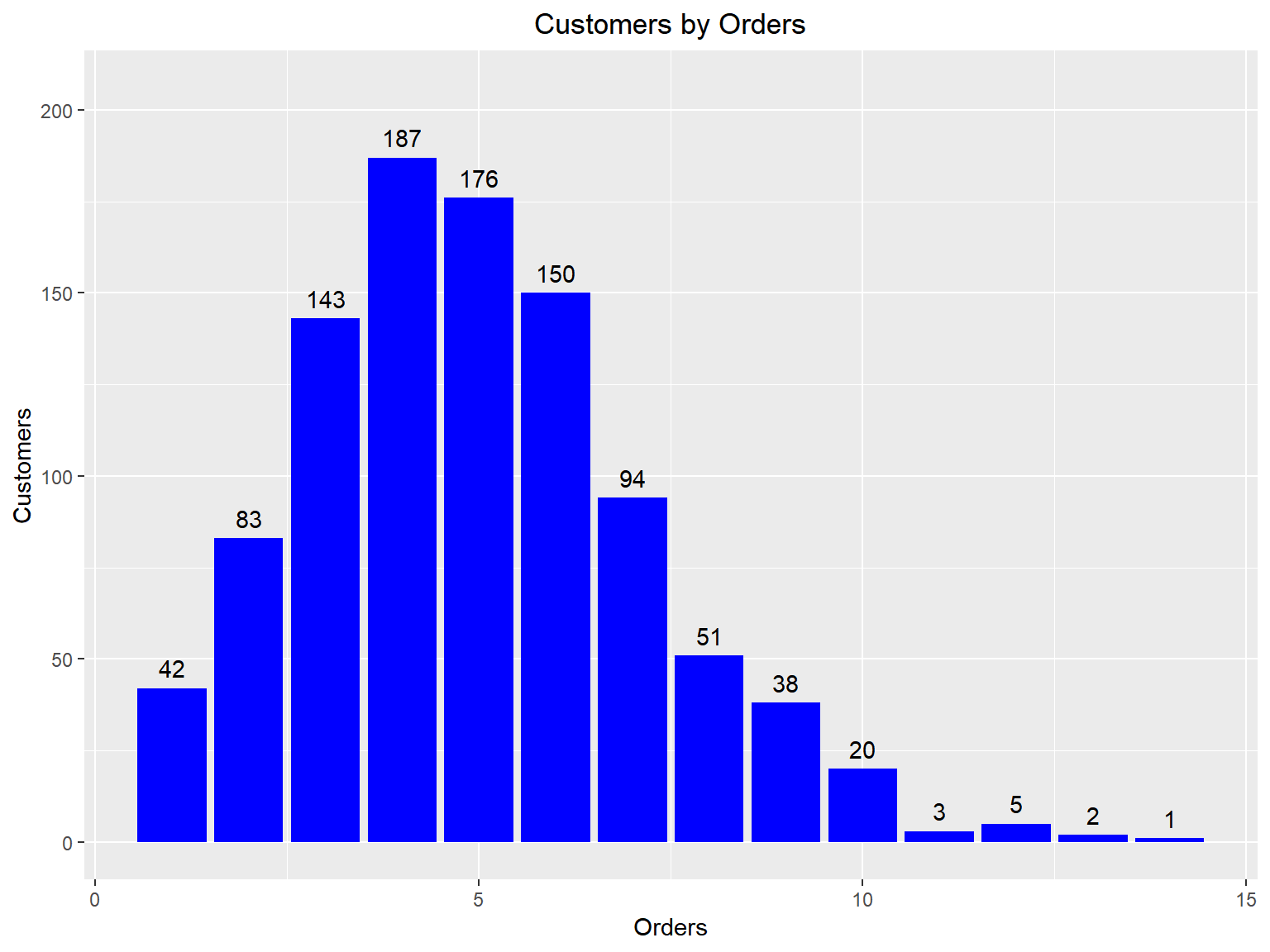

Customers by Orders

Visualize the distribution of customers across orders.

rfm_order_dist(rfm_result)

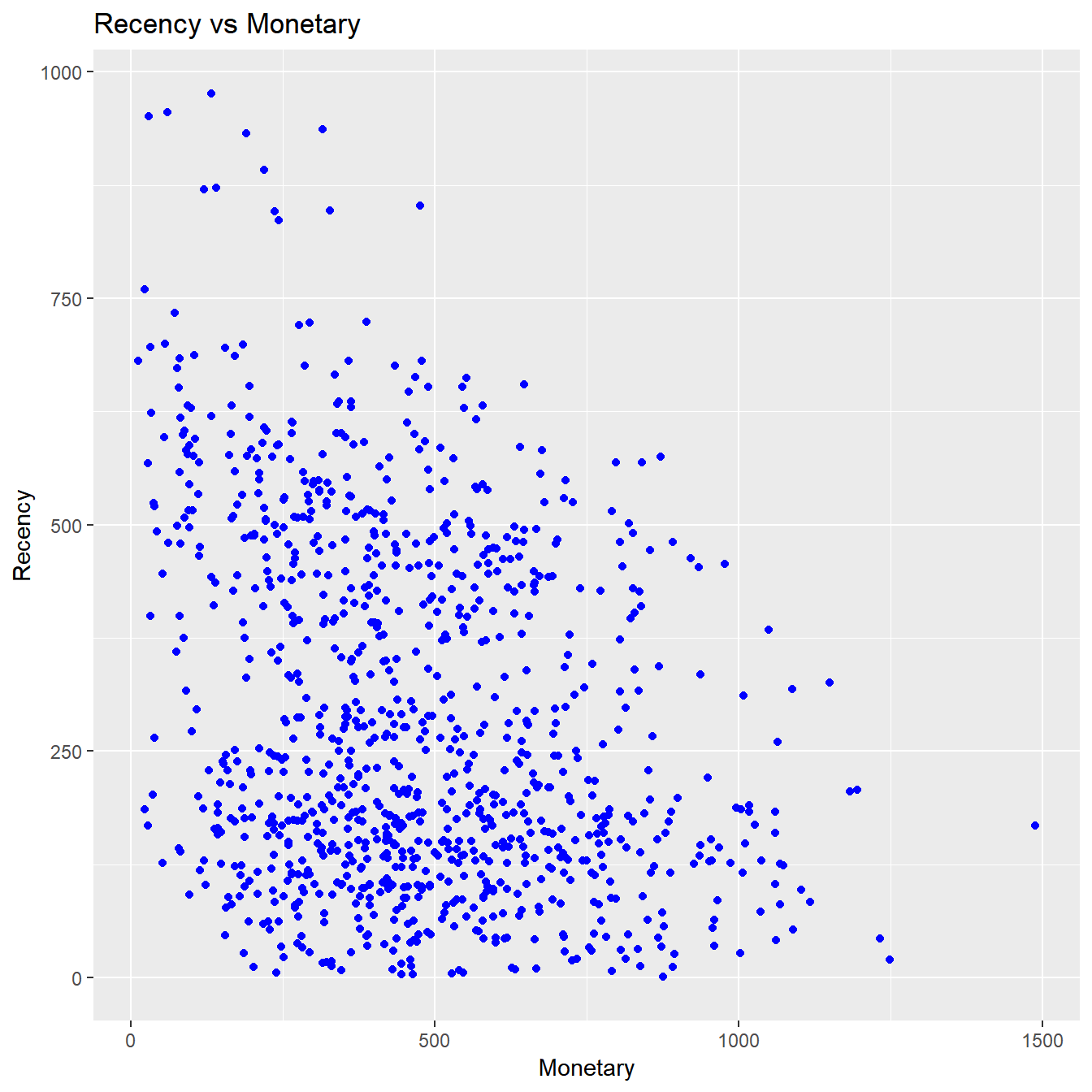

Scatter Plots

The best customers are those who:

- bought most recently

- most often

- and spend the most

Now let us examine the relationship between the above.

Recency vs Monetary Value

Customers who visited more recently generated more revenue compared to those who visited in the distant past. The customers who visited in the recent past are more likely to return compared to those who visited long time ago as most of those would be lost customers. As such, higher revenue would be associated with most recent visits.

rfm_rm_plot(rfm_result)

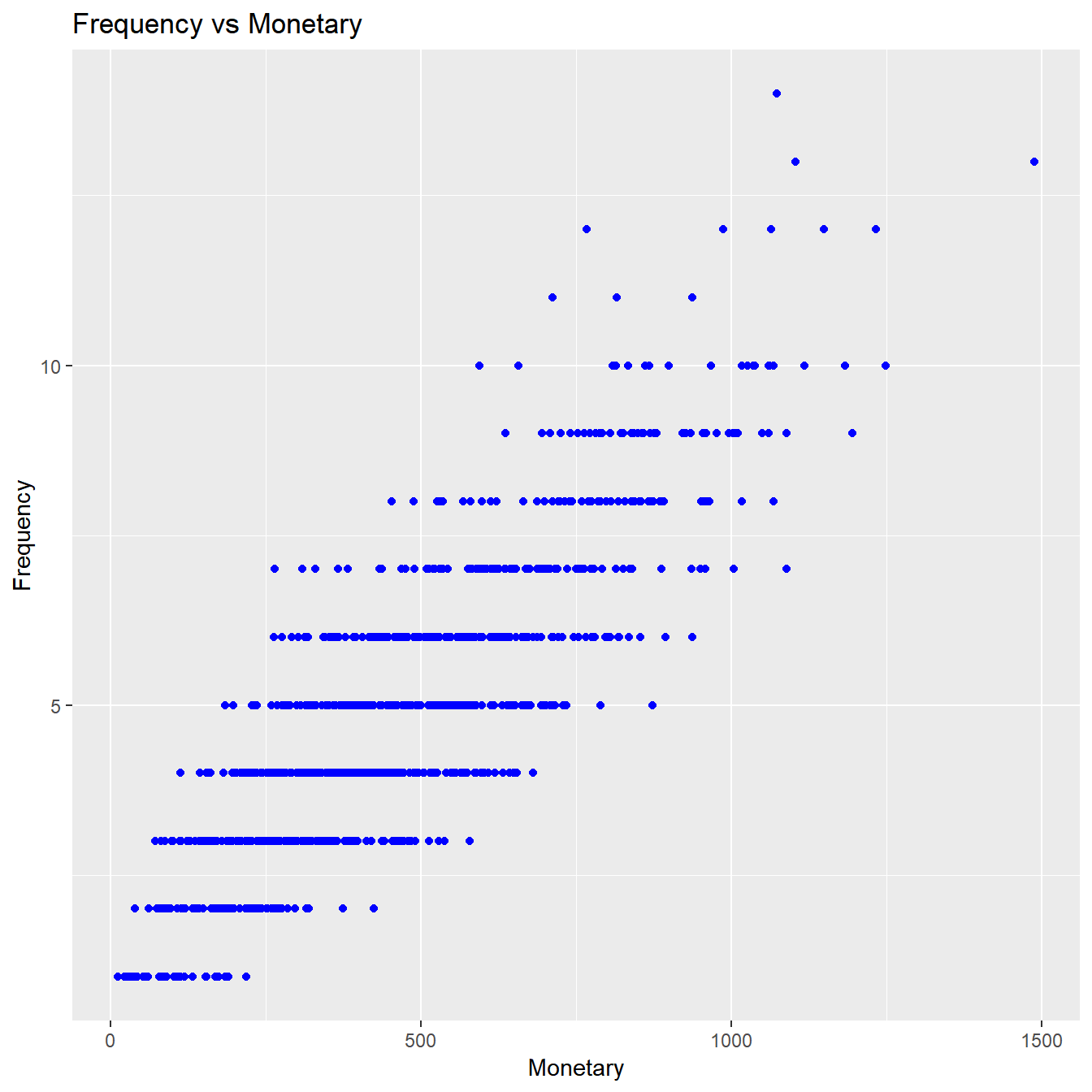

Frequency vs Monetary Value

As the frequency of visits increases, the revenue generated also increases. Customers who visit more frquently are your champion customers, loyal customers or potential loyalists and they drive higher revenue.

rfm_fm_plot(rfm_result)

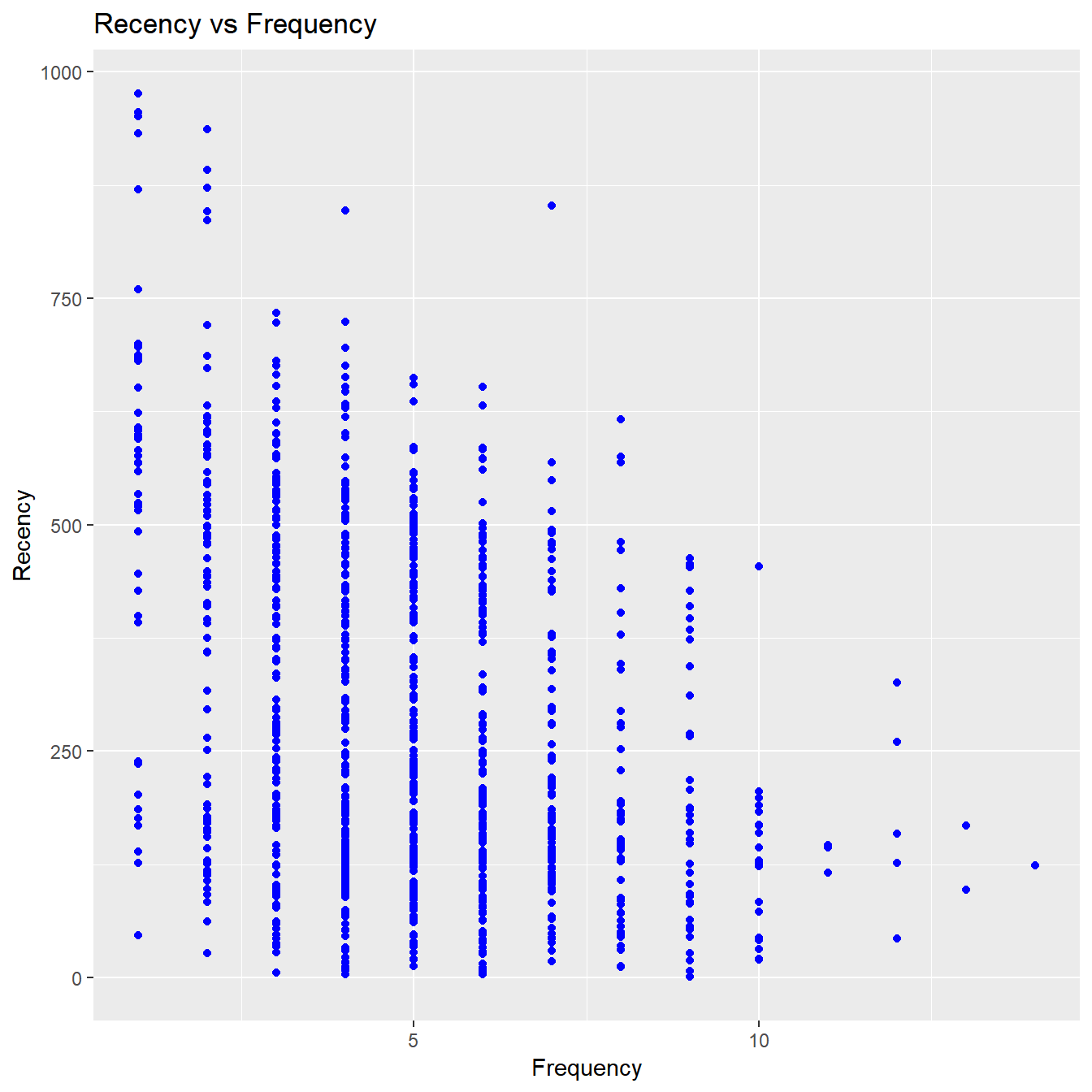

Recency vs Frequency

Customers with low frequency visited in the distant past while those with high frequency have visited in the recent past. Again, the customers who visited in the recent past are more likely to return compared to those who visited long time ago. As such, higher frequency would be associated with the most recent visits.

rfm_rf_plot(rfm_result)

Learning More

The rfm website includes comprehensive documentation on using the package, including the following articles that cover various aspects of using rfm:

RFM Customer Level Data - shows you how to handle customer level data.

RFM Transaction Level Data - shows you how to handle transaction level data.

Feedback

rfm has been on CRAN for a few months now while we were fixing bugs and making the API stable. All feedback is welcome. Issues (bugs and feature requests) can be posted to github tracker. For help with code or other related questions, feel free to reach me hebbali.aravind@gmail.com.